Time rounding, a common payroll practice, could be nearing its end at— least in California. The California Supreme Court has heard arguments over the past couple of years on cases that could put a stop to time rounding in the state. One of them is Camp v. Home Depot USA, Inc. which alleged the home improvement store’s policy to round employee hours to the nearest quarter hour resulted in unpaid minimum and overtime wages. The consensus in some of these cases is with the time tracking technology available today, there is no need for time rounding. So, if you’re still using time rounding for payroll, now is the time to think about bringing your time tracking into the 21st century.

What is Time Rounding?

Time clock rounding is the rounding up or down the hours an employee works. A common example is rounding an employee’s hours to 8 a.m. when the actual clock in time is 7:58 a.m. and rounding to 5 p.m. if he or she clocks out at 4:57 p.m. According to the Department of Labor (DOL), timesheet rounding is an acceptable practice if it’s within certain criteria. For example, an employer’s timesheet rounding can never be construed as favoring the employer over the employee. The DOL states that rounding cannot result, over a period of time, in a failure to compensate employees for the time they worked.

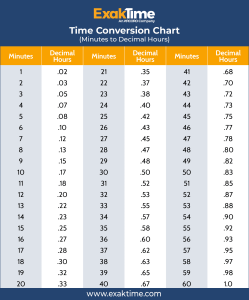

Time rounding is typically used so payroll doesn’t have to convert hours to decimals, which can take extra time. Converting hours and minutes to decimals requires more work than simply adding a period between those hours and minutes. For example, if your employee works 40 hours and 23 minutes one week, you can’t multiply 40.23 by the hourly pay to get the correct wage. Instead, the minutes must be converted to decimals. Converting minutes to decimals requires dividing the minutes by 60. For example, 23 minutes is .38 decimal hours. See our quick minutes to decimal conversion chart below.

But all this work is moot when you use a digital time tracking system that captures the exact time an employee works – something the California courts is taking into consideration.

In a 2021 ruling, the California Supreme Court questioned the need to time rounding due to electronic timekeeping systems’ ability to record time punches to the nearest minute or second, stating, “it is not clear what efficiencies were gained” by rounding as opposed to simply recording and paying for all time worked.

ExakTime Offers a Better Solution

ExakTime’s digital time tracking eliminates the need for time rounding, saving users time and helping maintain compliance. ExakTime quickly, easily and securely logs every minute of worker time. Our cloud-based technology uses photo ID to accurately capture who is clocking in and when, so there’s no questions surrounding time theft. GPS tracking capabilities go a step further by telling you where your workers clock in, so you’re only paying them when they’re on the job. But the best part about ExakTime is that it integrates with your existing payroll package allowing you to quickly export your employees’ data for payroll, no conversions necessary.

We offer easy integration with QuickBooks and QuickBooks Online, Sage 100 Contractor & Master Builder, Sage BusinessVision and other valued partners. Our system:

- Automates database transfer and system setup

- Shares ExakTime Connect time tracking data with your payroll application

- Exports attendance records in seconds

- Ensures paychecks are accurate and on time every week

- Frees time for other office responsibilities

Reduce your need for time rounding and eliminate payroll errors with ExakTime’s solutions.

Contact us to see how it can update your payroll processes.